17+ Salary Calculator Kentucky

The Income Tax calculation for. Web Paying Payroll Taxes.

How To Make Contributions In Nps Do We Have To Invest Monthly Or Annually Or Is There An Autodeduction From An Account Quora

Web Kentucky Paycheck Calculator Calculate your take-home pay after federal Kentucky taxes Updated for 2023 tax year on Sep 19 2023 What was updated.

. Just enter the wages tax withholdings and other. Web Kentucky State Tax Calculation for 8500000 Salary. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

Web Use our income tax calculator to estimate how much tax you might pay on your taxable income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Web This class receives a 1000 exemption but is otherwise subject to the tax with rates beginning at 4 for amounts greater than the 1000 exemption and.

Web All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net pay for both federal and. Web Kentucky Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Web This paycheck calculator also works as an income tax calculator for Kentucky as it shows you how much income tax you have to pay based on your salary.

Web Kentucky Paycheck Calculator. Web So if you earn 9890 per hour your annual salary is 18000000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours. Understanding Your Pay After Tax in Kentucky Your net.

Supports hourly salary income and. Web Kentucky Salary Paycheck Calculator Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Use our paycheck tax.

This free easy to use payroll calculator will calculate your take home pay. Web So if you earn 7418 per hour your annual salary is 13500000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours. Using a Payroll Tax Service.

Web Kentucky Hourly Paycheck Calculator. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Tax year Job type.

Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use the Kentucky Paycheck Calculator to estimate net or take home pay for salaried employees.

The table below details how Kentucky State Income Tax is calculated in 2024. Menu burger Close thin. Web Our paycheck calculator for Kentucky helps you estimate your take-home pay considering all state-specific taxations.

Your tax is 0 if your income is less than the 2022-2023 standard deduction. Enter your info to see your take home pay. Simply enter their federal and state W-4.

Chapter1n2reviewer Pdf Course Sidekick

Neuronblocks Autotest Dataset Knowledge Distillation Text Matching Data Valid Autotest Tsv At Master Microsoft Neuronblocks Github

16071 Winding Ridge Trl Louisville Ky 40299 Zillow

Corporate Tax In The United States Wikipedia

Mypaddi On The App Store

Kentucky Salary After Tax Calculator 2024 Icalculator

What Is The Best Number Of Years Of Getting A Personal Loan 16 5 Reducing Interest Rate Maximum 7 Years In Case Of High Inflation 25 Yearly Quora

Kentucky Paycheck Calculator 2023 Investomatica

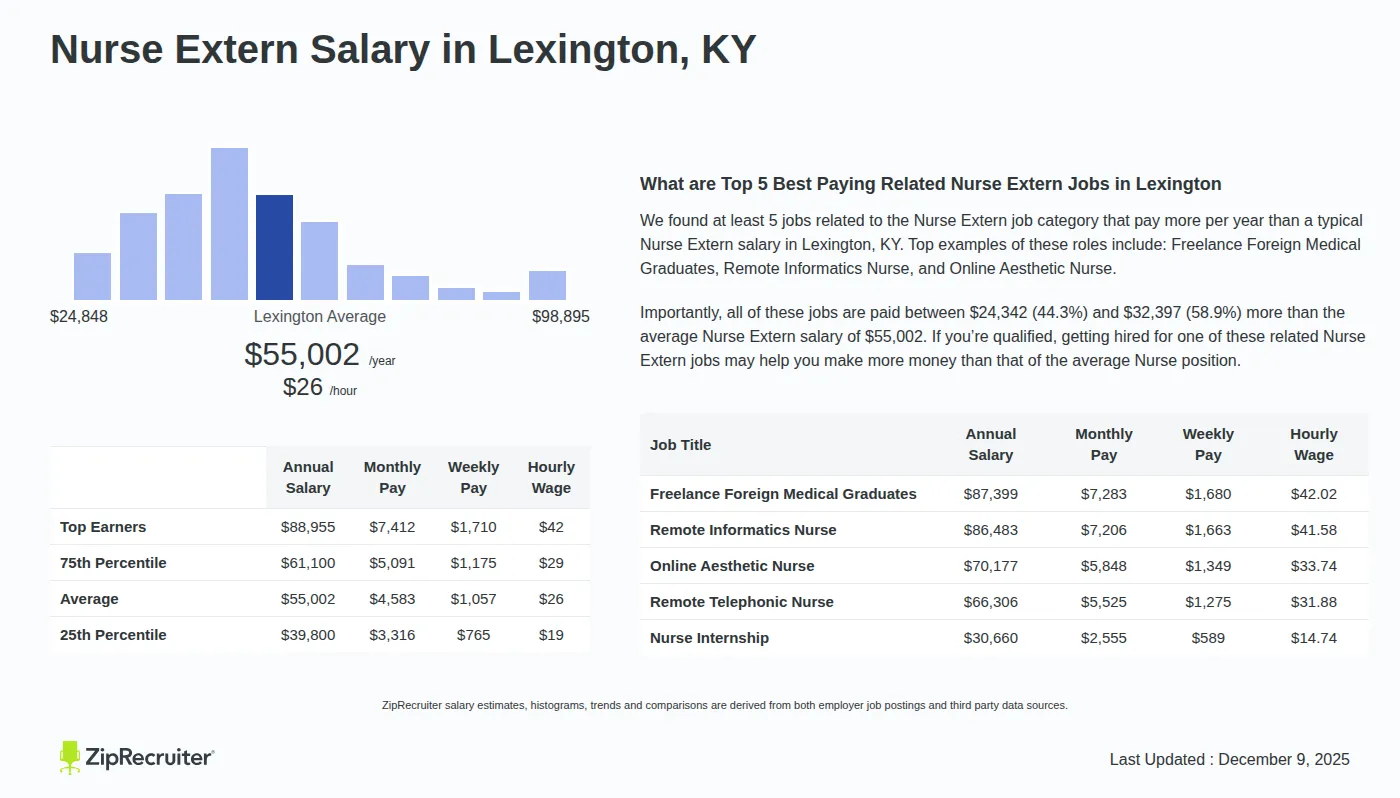

Nurse Extern Salary In Lexington Ky Hourly Rate Oct 2023

Salary Provost In Kentucky October 2023

Yqme50hpmtgn8m

How Far A 50k Salary Would Get You In 30 American Cities Titlemax

16071 Winding Ridge Trl Louisville Ky 40299 Zillow

Estimate Your Benefits Arizona State Retirement System

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Mountain Xpress 11 16 22 By Mountain Xpress Issuu